Savvy depositors are now looking for reputable digital banks that offer competitive interest rates after ING Philippines announced its exit from retail banking in the Philippines. Here comes Netbank, a new digital bank with a jaw-dropping interest rate! Since going live last July 29, Netbank Mobile is offering 7% per annum interest on regular savings accounts. They also offer up to 6% per annum interest rates on time deposits.

In this post, we’ll discuss the experience of opening an account at Netbank Mobile, its mobile app, and its features.

What is Netbank Mobile?

Netbank is a BSP-regulated bank that operates under the Community Rural Bank of Romblon (Romblon), Inc.’s rural banking license. It provides Banking-as-a-Service solutions in the Philippines, providing low-cost, high-quality banking services to Fintech and other financial services companies on a white-labeled basis. It will enable Filipino Fintechs to grow quickly while lowering their expenses, hence promoting financial inclusion and innovation.

Aside from regular deposit and time deposit accounts, its mobile app features bills payment (powered by ECPay) and mobile reload. You can send and receive money using Instapay and PESOnet services. Over-the-counter cash-in/cash-out channels (ECPay, 7-11, M Lhuillier, and Panalo Express) are also available for sending and receiving funds.

How to Open an Account in Netbank Mobile

Opening an account in Netbank Mobile is fast and straightforward. You just have to download the mobile app on your device, create an account, then provide the necessary documents. In a few minutes or hours, you will have your Netbank account and start earning a 7% p.a. interest rate on your savings account.

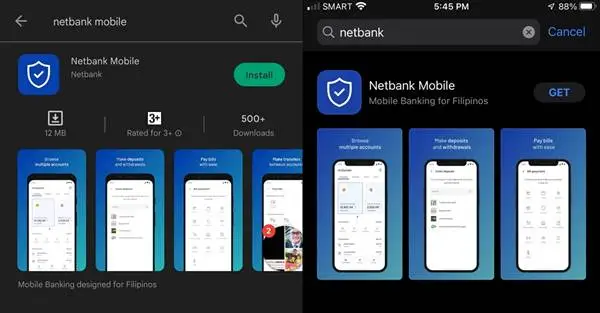

1. Download the App

Download the Netbank Mobile application on your Android or iOS mobile device. If you are having trouble installing the app on Android, make sure to turn off the developer options and do not root your device! Most, if not all banking and financial apps are incompatible with rooted phones. Rooted phones pose a significant security risk, and using banking apps on them is not recommended.

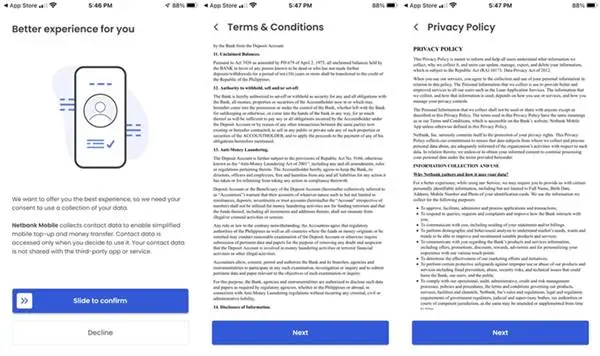

2. Accept TOS and Privacy Policy

Tap the app to launch. Netbank will ask for your consent for the collection of your data and then use the slider to confirm. On the next window, just click the next button to accept the Terms of Services and Privacy Policy.

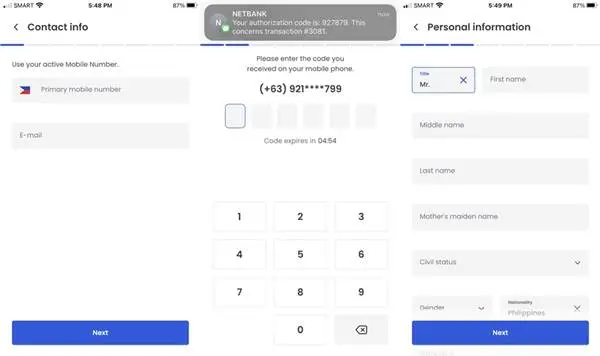

3. Provide Contact Information

Enter your mobile phone number and email address in the spaces provided. Make sure to provide a mobile number you have access to. Wait for the one-time password to arrive then enter the code you have received on your mobile phone. As soon as you receive the OTP, enter it right away because it will expire in five minutes. If you fail to enter the code within the allotted time, you have to resend the authorization code request again.

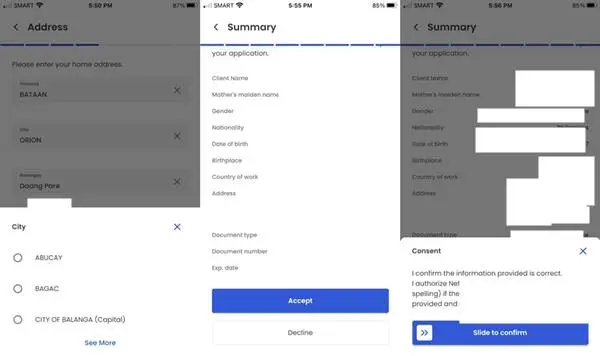

4. Create your Account

Fill out the online application form and provide the necessary information. When entering the address information, use the drop-down menu then click the “see more” link to reveal the other options. Check if all the provided information is correct then tap the “Accept” button. You will now be asked to upload a government-issued ID and a copy of your signature. Make sure to provide an ID with an indicated address, otherwise, you have to provide Proof of Address later on just like the other neobanks. After uploading the required documents, use the slider to confirm that the information provided is correct. It will also authorize Netbank to adjust details (such as name spelling) if there are differences between the data provided and the information in your ID. After submission, wait for the approval of your Netbank account.

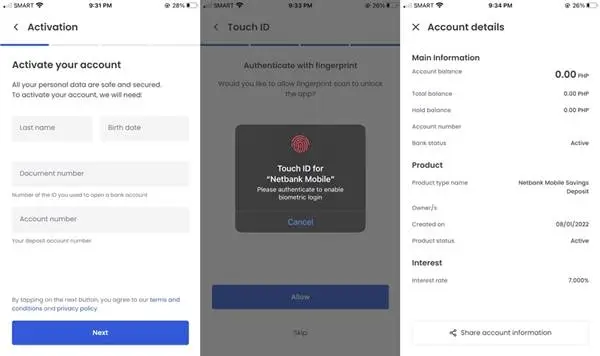

5. Activate your Account

Netbank will send you an SMS letting you know if your account has been accepted. In the same text message, you will also receive your account number. Enter your last name, birth date, document number, and account number to activate your account. The document number is the number of the ID you gave when you created your account.

After activation of your Netbank account, activate the Touch ID to allow authentication via fingerprint. You can now log in to your Netbank mobile app and start funding your Netbank savings account.

Netbank Interest Rates as of August 2022

Here are the prevailing interest rates of regular savings and time deposit accounts as of August 2022:

Netbank Mobile Savings Account

You can earn a 7% interest rate per year on your regular savings account. We are still waiting for the information about the duration of the promo. Please stay tuned for more updates.

Time Deposit Account

Earn up to 6% per year on your time deposit account with maturities of 3, 6, 12, or 24 months. Please check the table below for more information:

| TERMS (months) |

10,000 – 49,999 | 50,000 – 99,999 | 100,000– 299,999 | 300,000– 499,999 | >500,000 |

|---|---|---|---|---|---|

| 3 | 2% | 2.25% | 2.5% | 2.75% | 3% |

| 6 | 3% | 3.25% | 3.5% | 3.75% | 4% |

| 12 | 4% | 4.25% | 4.5% | 4.75% | 5% |

| 24 | 5% | 5.25% | 5.5% | 5.75% | 6% |

Transaction Limits and Fees

Here are the fees and limitations of using OTC, InstaPay, PESONet, and Intrabank fund transfers:

| TRANSACTION | FEES | LIMIT |

|---|---|---|

| InstaPay | ₱25/transfer | ₱50k/transaction, ₱50k/day |

| PESONet | ₱25/transfer | No limit |

| Intrabank | FREE | No limit |

| OTC Cash-in | Fees | OTC Cash-out | Fees |

|---|---|---|---|

| ECPay | ₱20 | M Lhullier | 2% of Transaction |

| 7-Eleven | ₱20 | ||

| M Lhuiller | ₱30 | ||

| Panalo Express | ₱40 |

Frequently Asked Questions (FAQs)

Here are the frequently asked questions about Netbank Mobile:

Is Netbank safe?

Yes, Netbank has a banking license from the Bangko Sentral ng Pilipinas (BSP) and it is fully-regulated by the BSP. Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to ₱500,000 per depositor.

What are the acceptable IDs to open a Netbank Savings Account?

You can open an account using any of the following documents:

- Passport

- OFW ID

- Seafarer’s Identity Documents

- Driver’s License

- PRC ID

- NBI Clearance

- Police Clearance

- Postal ID

- Barangay Certification

- GSIS e-card

- SSS ID/ UMID

- Senior Citizen’s Card

How long will I wait for the approval of my account?

Account applications before 5:00 PM during banking days will be processed the same day. Those accounts created after 5:00 PM will be processed on the next banking day. If you created an account after 5:00 PM on Friday, your account will be processed on Monday. Any account created during holidays will be processed on the next banking day.

How much is the minimum initial deposit?

There is no minimum initial deposit and no maintaining balance.

Can I deposit funds to my Netbank account without paying fees?

Yes, there is a workaround to avoid fund transfer fees when depositing funds to your Netbank account.

- Using ShopeePay – Fund your ShopeePay using your BPI or Unionbank account. You can transfer the money to your Netbank account using Instapay for free.

- Seabank – You can fund your Netbank account for free using InstaPay.

- Using CIMB and GCash– Fund your CIMB account using GCash GSave then transfer the funds to your Netbank account using InstaPay for free.

When will I receive the interest rate?

The interest will be credited to your account every month.

What is the minimum balance to earn interest?

You should have at least ₱1.00 on your account to earn interest.

Is my money safe if I lost my phone?

Yes, you cannot log on without your personally created password, and making fund transfers will require confirming your PIN.